Bitcoin’s Disappointing Performance Shows Why Having a Good Product Is Not Enough

In an episode of his Hardcore History podcast, host Dan Carlin once relayed a story of a college professor criticizing his analysis of events from the Middle Ages because they didn’t account for the role of magic. Carlin protested that we know magic isn’t real, to which his professor answered, “but they didn’t know that.”

One need not look far right now for examples of widely-held beliefs we might confidently reject after careful consideration, but that we disregard at our own peril. The idea that the fear of the COVID-19 pandemic will be worse than the disease feels like an avoidable self-fulfilling prophecy but is likely such a virulent idea that separating fear from the virus itself is an exercise in futility.

Markets are essential in societies with billions of interconnected participants because any individual’s knowledge is mostly local and limited in scope. But the solution markets provide is not perfect and the knowledge set forth above is not so cut-and-dry. We may often simply see different parts of the same whole, but human beings may also interpret those parts differently or allow what we already know to color how and what we observe.

Careful questioning of conventional wisdom is always warranted, but even when we are convinced that the herd is not to be followed, we forget its existence at our own peril.

Bitcoin’s hardcore community has long been convinced of its bulletproof economics but unless others are brought along the crypto community may find themselves both correct and broke.

There Are Only Libertarians on a Blockchain

Bitcoin largely owes its existence and growth to a small group of developers, entrepreneurs, and thinkers uncommonly animated by big economic, political, and philosophical ideas. A currency virtually untouchable by states or central banks, not to mention the giant financial intermediaries who curry their favor, naturally appeals to libertarian sensibilities familiar to many of our regular readers no matter their outlook on cryptocurrency.

Central to Bitcoin’s value proposition among true believers is the razor-sharp critique of government-issued fiat money made by Ludwig von Mises among others, showing how political incentives to manipulate the supply of printable currency often create the harmful boom-bust cycles they seek to dampen and ultimately doom the viability of the currency itself.

In what follows let’s assume they’re right (if you subscribe to other views on money, consider it a thought experiment). A puzzle immediately emerges, because what should be a relatively stable and safe asset behaves in its history thus far in the opposite manner.

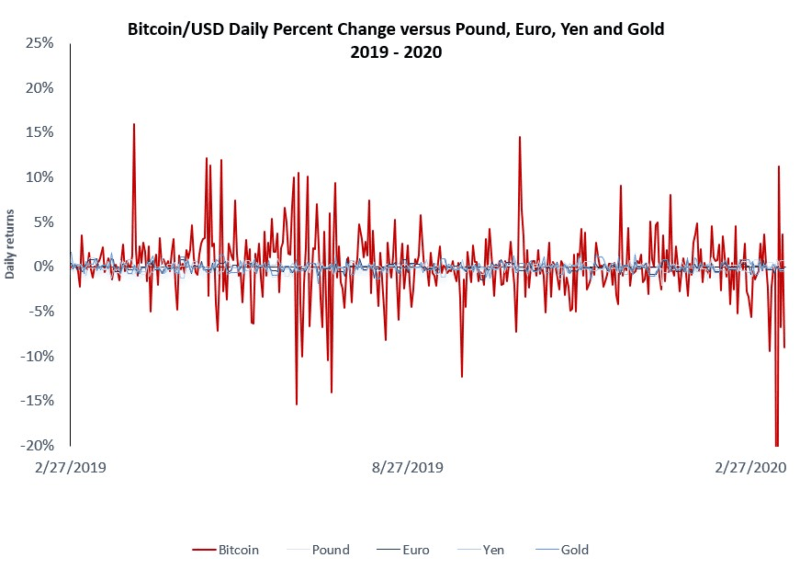

The price of Bitcoin in dollars has exhibited strikingly more daily volatility than widely-used fiat currencies. The chart below updates a picture we’ve shown before–whether bullish or bearish in longer-term price movement, daily changes up or down of several percentage points without easily identifiable news are the norm (other popular cryptocurrencies show even more daily volatility).

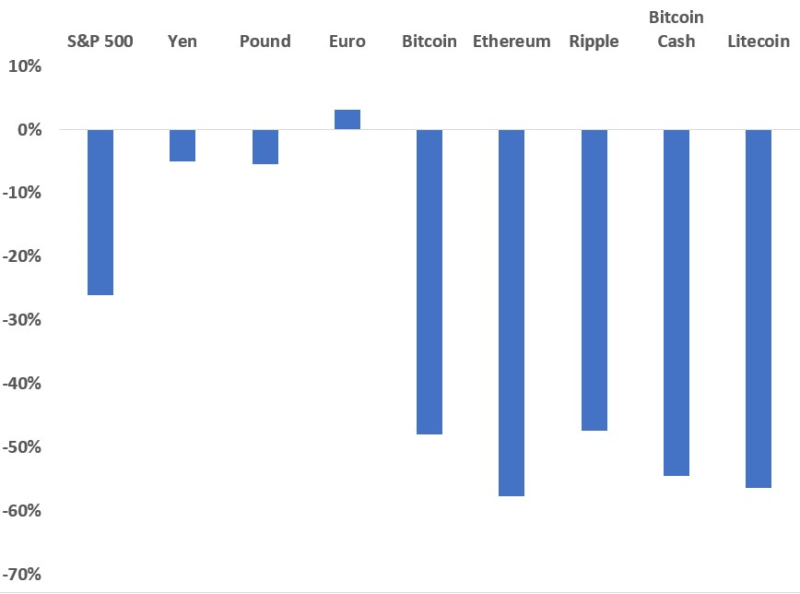

Some Bitcoin backers have argued that this day-to-day volatility will fall over time, others that it’s a feature rather than a bug, allowing for the system as a whole to remain stable as the daily price sways like a skyscraper in the wind. Were that the case, perhaps the global economy’s harrowing recent experience in the wake of the COVID-19 pandemic–likely the biggest threat and disruption to business as usual around the globe in decades–would make holding Bitcoin more attractive to investors at large. It appears to have done just the opposite.

My view is that these results say nothing at all about the economic views that motivate the community that began coalescing a decade ago. The volatility and vulnerability to global risk we see are more indicative of a failure of entrepreneurship.

More Magical Thinking

Opposition to government fiat currency may be the majority view among people producing commentary on Bitcoin, but only a small minority view among the general investing public. Ludwig von Mises himself saw the uphill climb his critique of fiat money faced just as clearly as the critique itself, as once again the role of magic seeps into practical considerations in the real world:

For the naive mind there is something miraculous in the issuance of fiat money. A magic word spoken by the government creates out of nothing a thing which can be exchanged against any merchandise a man would like to get. How pale is the art of sorcerers, witches, and conjurors when compared with that of the government’s Treasury Department!

The current majority view among economists, problematic though it may be, casts central banks with discretionary control over supplies of fiat money as an essential stabilizing force rather than the roots of recession. More investors still have never thought about the question, following the advice of advisors and going on about their lives.

No matter how confident the most ardent backer of Bitcoin is that their beliefs will be vindicated in the long run, performance in the midst of a wider crisis will reflect flawed conventional wisdom. More people have to believe Bitcoin is a safe asset when governments and central banks teeter for it to behave like one.

The 108 years that have passed since Mises lamented the magic of fiat money are a testament to how hard it is to change minds or raise questions. Much ink has been spilled on sound money but why would the average person on the street forsake their concept of what money is in favor of a technology and approach to governance so novel that few understand it concretely? Two scenarios come to mind.

First, the dollar could collapse, the type of financial apocalypse long predicted by critics of central banking. This fate for fiat money is theoretically inevitable–no government lasts forever–but far from guaranteed to happen in anyone’s lifetime.

What’s more, a vindication of dollar doomsayers would in no way imply an acceptance of Bitcoin. The average investor would be more likely to reach for what they already view as safe, whether gold or some new government-imposed workaround.

AIER Editorial Director Jeffrey Tucker spots the only realistic path toward a mass rethinking of money, and the missed opportunity to turn down that path during the great scaling debate, when most core developers chose economic principle over meeting the needs of their potential user base:

“Adoption hasn’t gone far enough,” Tucker said, “and it hasn’t come into consumer use like it should and would have if it had been able to scale. Now we’re seeing what happens when Bitcoin was not properly scaled.”

People not accustomed to losing themselves in hours of deep thought about economics need tangible incentives to start questioning assumptions about money they barely know they have. We usually think of learning as fueling adoption of novel technologies, but that street runs two ways. There’s nothing like a useful new product to catalyze people to learn and build intuition.

Had developers prioritized scaling the Bitcoin network to make it a useful payment system for people, they might have learned more about money and private governance than they bargained for. If that sounds far fetched, consider what people could learn from this short video by Bitcoin commentator Vin Armani.

Instead of giving the majority of people a reason to question their assumptions through an exciting or useful product, albeit one that began crossing the Rubicon of radical decentralization, Bitcoin’s truest believers chose the clean aesthetics of economic theory. If correct such theory should win out in the end, but the end could outlast all of us.

Developers, miners, and other players in the Bitcoin community should not let the next opportunity to make the blockchain-based currency useful pass. Bitcoin can’t be the asset many of its developers want it to be without incentivizing the type of curiosity needed to change deeply held beliefs.