A Glimmer of Hope Amid Economic Devastation

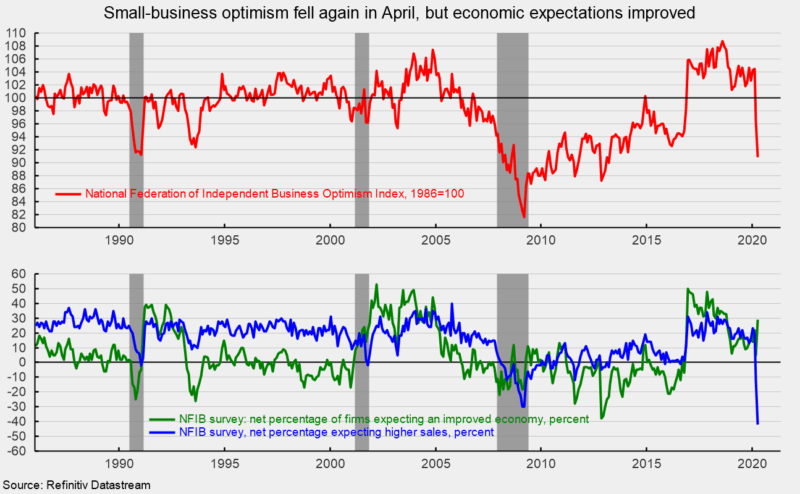

The small-business-optimism index from the National Federation of Independent Business recorded another sharp drop in April, falling 5.5 points to 90.9 versus 96.4 in March (see top chart). Two consecutive sharp declines put the index at its lowest level since March 2013.

According to the report, “The business impact from COVID-19, government stay-at-home orders, and mandated nonessential business closures have had a devastating impact on the small business economy. A collapse in sales has led to lower earnings and dampened employment prospects for months to come. However, small business owners remain optimistic in the face of adversity as more expect the economy to improve over the next six months.”

A net -42 percent of respondents expect higher sales over the coming months, down from -12 in March, while a net -11 percent report higher sales for the most recent three months versus the prior three months (see bottom chart). The result for the sales expectations index was the lowest on record. Not surprisingly, the net percentage reporting lower earnings over the prior three months dropped to -20 following a -6 reading in March.

The plunge in sales as a result of the collapse in economic activity has pushed sales to the top position on the list of most important issues for small businesses. Among the 10 issues listed in the survey, poor sales ranks first at 19 percent, quality of labor ranks second at 15 percent, tied with taxes, while government regulation and red tape was fifth on the list at 10 percent.

Despite the record low expectation for sales over the next three months, the net percentage believing the economy will improve six months from now rose, posting a solid 24-point gain to a net 29 percent (see bottom chart).

That optimism, while a good sign, is not translating to business decisions. The net percentage of respondents believing now is a good time to expand came in at 3 percent, down from 13 in March. Furthermore, the percentage of firms planning to increase employment dropped to 1 percent in April versus 9 percent in March while a net 24 percent of firms still report having openings they are not able to fill at the moment, down from 35 percent last month. A modest silver lining to the surge in unemployment, the percentage of firms reporting few or no qualified applicants for job openings fell to 41 percent, down from 47 percent in March, and is now 16 points below the record 57 percent from August 2019.

Eighteen percent of firms have plans for capital expenditures over the next three to six months, down from 21 percent from the prior month. Fifty-three percent of small businesses have made capital expenditures during the past six months. That is somewhat below the typical percentage in the upper 60s during the late 1990s but still above the mid-40s percentages during the last recession. The most popular type of expenditure was equipment (36 percent) followed by vehicles (21 percent) and building/land improvement (13 percent). The most popular outlay range was $10,000 to $49,999. Overall, the survey suggests the small-business sector of the economy is struggling with the dramatic impact of COVID-19 and government policies enacted to contain the spread of the virus. While the government support programs are helping, small businesses need the economy to re-open as quickly as possible.