2020-2030 Could Be the Decade of Economic Malaise

To say the future looks bleak for sound economics and good government would be an understatement. The year 2020 has seen an unprecedented expansion of government intervention that has absolutely devastated the global economy. It is highly unlikely that national governments will simply put those powers back into the lockbox; they will likely keep them for years to come. Even in the short term, lockdowns do not seem like they are going away anytime soon with countries like France and Germany already reclosing their economies. On top of that, debt and spending have soared astronomically in response to Covid-19 as if existing debt wasn’t high enough. AP News writes

In August, CBO issued a 10-year estimate predicting the deficit would decline to $1.8 trillion in the 2021 budget year that began Oct. 1 and would register $13 trillion over the coming decade. It would average 5% of GDP over that time, a level that many economists fear could lead to higher interest rates and a stagnating economy.

We have absolutely no idea what that amount of quantitative easing and low interest rates will mean for the health of the economy in the long run. It’s entirely possible if not likely that there could be a massive financial crisis in the next few years as the central bank-fueled stock bubble pops.

Finally, both the Democratic and Republican Parties have a concerning rise in populist, anti-free market ideologues. The Progressive movement within the Democratic Party led by open Socialists such as Bernie Sanders and Alexandria Ocasio-Cortez is very much assuming control. The Republican Party has been slowly ditching its commitment to markets as well with the Trump administration’s protectionist policies and the rise of more nationalists such as Senator Josh Hawley who are constantly attacking tech companies. Both sides, if in power, will ramp up government intervention in the economy, leading to stagnation and turmoil.

Although the challenges that will arise this next decade will be novel, they will not be without precedent. If we look back just a few decades we will see a hint of what might come as well as the way out of this.

The Fallout of a Biden or Trump Presidency

With the election just days ahead at the time of my writing, I do not have much optimism for either Biden or Trump in preventing the aforementioned economic malaise.

Joe Biden advertises himself as a bulwark against the far left of American politics and pledges to uphold core American values such as a more restrained government and capitalism. That is absolute fantasy. His vice presidential pick, Kamala Harris, is one of the most progressive voices in the US Senate. She has campaigned on ideas such as ending private healthcare and packing the Supreme Court. As we speak, Elizabeth Warren is being promoted as a potential Treasury Secretary. Joe Biden has also created a “unity task force” with Bernie Sanders. The progressive movement in the United States is very much alive and well. It is unashamed to align itself with socialist ideas that will only continue to grow in the near future. Expect much higher taxes, greater regulation, and a far more involved government in another attempt at central planning. We know where this leads and it’s not good.

A Donald Trump presidency may seem like a slightly better option for preventing economic turmoil but slightly better is the best you should expect. To Trump’s credit, his regulatory reform has been historic. According to this fact sheet provided by the White House, the Trump administration has accomplished significant efforts in rolling back onerous red tape, which directly contributed to the economic growth pre-Covid.

Although this will likely continue under a Trump presidency, that is about as much credit as I can give. Trump and the populist movement within the Republican Party are diametrically opposed to free markets as well as limited government. Trump’s trade wars will likely continue, as a report by Brookings points out that

“U.S. economic growth slowed, business investment froze, and companies didn’t hire as many people. Across the nation, a lot of farmers went bankrupt, and the manufacturing and freight transportation sectors have hit lows not seen since the last recession. Trump’s actions amounted to one of the largest tax increases in years.”

Trump’s protectionist agenda is just a more mild form of central planning favored by the Democrats. Many Republicans have also ditched the principles of limited government and free markets for Trump’s populism which is exemplified by their recent antitrust sentiment towards big tech companies. This nationalist movement within the Republican Party is similar to the progressive movement in that it will likely be a new way forward for the foreseeable future. Just look at the size and influence of the National Conservative movement.

Both sides of the political spectrum are poised to unravel the foundations of limited government and sound economics in favor of populism and the fatal conceit that the state can plan a prosperous society.

The Fallout from Covid-19

It goes without saying that the policies taken by governments throughout the world have been frightening. Never before have free societies been subject to so many draconian restrictions in a time of peace. AIER has written countless articles detailing the truly horrific behavior that has taken place from business closures to civil rights violations, to power-hungry governors. The New York Post writes

The nation is in for a gradual economic recovery from the “depression-like crisis” sparked by the pandemic, with production and employment likely to remain under pressure through the end of 2022, according to the projections from the UCLA Anderson School of Management.

These estimates would be contingent on the assumption that nothing else happens. It is highly unlikely that governments will simply relinquish the unprecedented powers they created. Furthermore, the damage Covid-19 has done to our social fabric by increasing anxiety and polarizing people beyond reason will likely have lasting consequences.

The Looming Financial Crisis

To say that we have entered a monetary unknown would be an understatement. The US government has printed trillions of dollars to finance stimulus payments which only adds to the mountain of debt. Investopedia reports

“The Congressional Budget Office estimates that the U.S. federal debt held by the public will reach 98.2% of GDP, or $20.3 trillion, by the end of 2020.”

CNN Business reports that

“The US federal budget is on an unsustainable path, has been for some time,” Federal Reserve Chairman Jerome Powell said this week. But, Powell added, “This is not the time to give priority to those concerns.”

However, when the country eventually pulls out of its current health and economic crises, Americans will be left with a debt hangover.”

Eventually, we are going to have to confront this debt crisis, which would more than likely involve cutting spending and maybe even raising interest rates. All of which would be highly disruptive but unavoidable. This would be on top of our existing monetary issues created by corporate bailouts and financial markets supported by quantitative easing, not real growth.

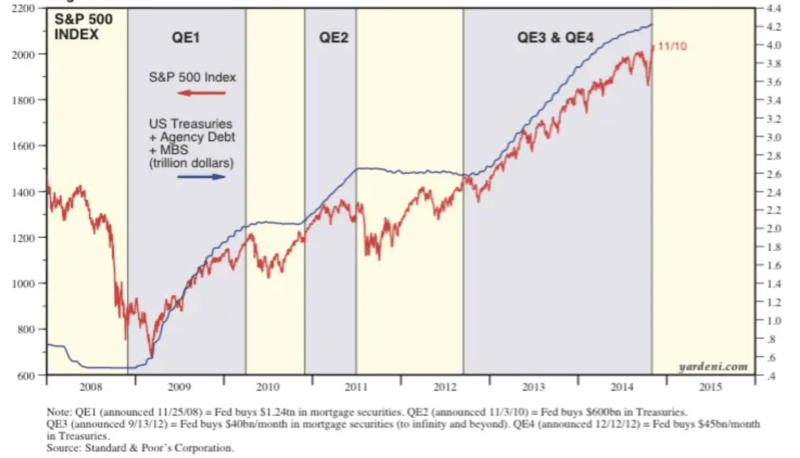

As seen by this chart Federal Reserve stimulus has essentially been artificially inflating the value of the S&P 500. Such a policy is incredibly dangerous because it creates a situation where cutting off support would likely lead to a recession. However, printing money forever is impossible, and the longer we wait to resolve this issue, the more severe the financial crisis will be. Covid-19 and the stimulus spending that accompanied it may well have accelerated the timeline.

Lessons from History

Although the challenges that will likely await us in the immediate future will be new, they are not exactly without precedent. The rise of socialism and economic nationalism are very familiar in fact. The 1970s in Britain and the US are what come to mind.

During this time the United Kingdom was considered the sick man of Europe because its economy was so bogged down by government regulation while inflation along with unemployment soared. Andrew Stuttaford writes

“Complacency, systematic underinvestment, mounting trade-union militancy, and (after a Labour government took over in 1964) ever higher levels of taxation and government intervention in an economy already burdened by too much of both, all took their toll.”

Many parts of the British economy were under national control; things that are today private but at the time were considered something so special that only the government could run it. The result was obvious as the inefficiency and incompetence of central planning took its toll. So much so that in 2013 Martin Wolf in the Financial Times wrote

“Even Ed Miliband’s Labour party has not dared to suggest a return to the policies of the 1970s.”

The United States had its own bout of economic malaise at the same time as it too experimented with big government policies that went against the laws of sound economics. Janet Ngyuen writes of one example where

“The Nixon administration ended up introducing wage and price controls from 1971 to 1974, but this only slowed down prices while increasing food and energy shortages. However, these ended up failing, with ranchers deciding to stop shipping their cattle to the market and consumers emptying the shelves of supermarkets.”

Onerous and overbearing government involvement in the private sector does not lead to good consequences as those in the 1970s discovered. No society has ever regulated or taxed its way into prosperity, and our politicians today should realize that. The laws of sound economics are not a suggestion as those in the 70s learned the hard way.

Every action has an equal and opposite reaction. The current socialist/populist backlash was certainly in response to economic liberalization. The election of Trump was a backlash to Obama. The election of Margaret Thatcher in the UK and Ronald Reagan in the US were very much a reaction to the economic malaise of the 1970s. Although they were in no way perfect, their policies were often based on sound economics, liberalization, and deregulation. Both these heads of state explicitly subscribed to the ideas of legendary economists such as Milton Friedman and Friedrich Hayek. They ended the economic malaise of the 1970s and catapulted their respective countries to decades of prosperity.

The 2020s will likely be a time of economic hardship as we reckon with the consequences of our current and future policies. The populist backlash against markets will likely continue and socialism will grow in influence. We may very well have to face a painful financial correction based on the trajectory of our monetary policies. However, if history shows us anything, this experience may very well spark a renaissance for the ideas of limited government and markets. If only we could learn this the easy way rather than the hard way.